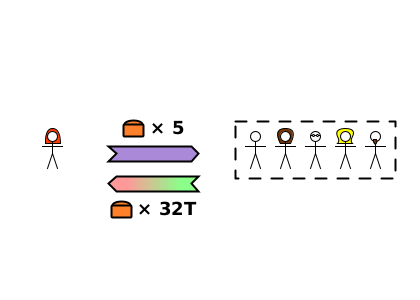

With Alice’s Ponzi scheme, as soon as she made a promise she couldn’t keep, making her insolvent, someone else was certain make a loss1.

At first it would have been Bob2, but he (unknowingly) avoided it when Charlotte joined the scheme. Finally, the loss which was going to be Charlotte’s was shifted to Dom, when Alice gave Charlotte most of the money he “invested”. Nobody else joined Alice’s scheme, so Dom was the one left with the loss.

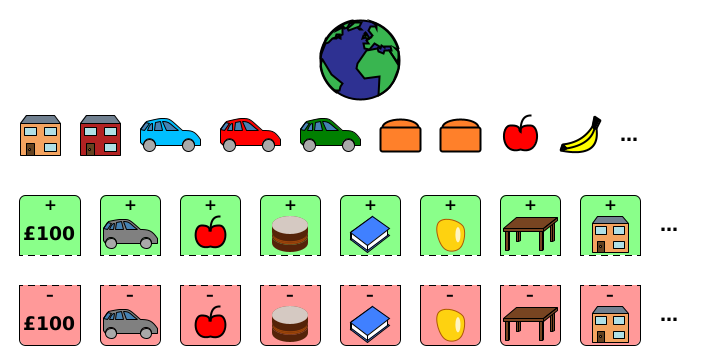

In last week’s post, we saw that the raw net worth3 (RNW) of a group is the sum of the RNWs of the individual members. And this is as true for the whole world as it is for any smaller group. Because there are no inter-planetary debts (at the moment), the debt assets which increase the world’s RNW and the liabilities which decrease the world’s RNW are all paired up, so the effects cancel each other out, leaving the world’s RNW as just the sum of all tangible assets.

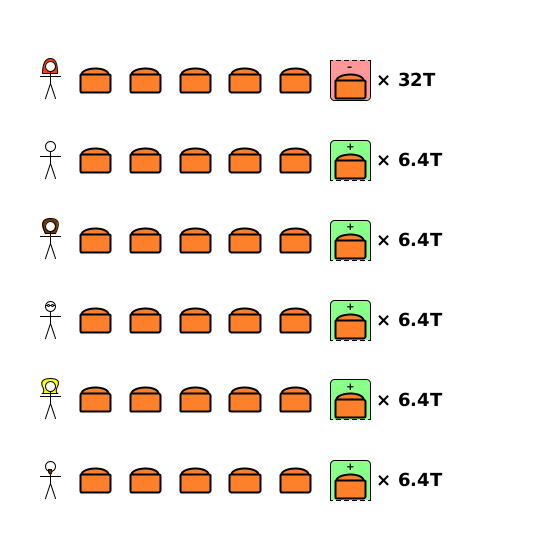

Even when someone is insolvent, the world’s RNW is still the sum of all tangible assets. The debt assets and the liabilities (some of which can’t be paid) still form matching pairs. But something strange happens. To see what, imagine a simple example where the world population is just 6, and each person owns just 5 loaves of bread. Alice is extremely insolvent: she owes 32 trillion loaves of bread to the other people (6.4 trillion loaves each).

The world as a whole group:

Owns 30 loaves

Is owed 32 trillion loaves

Owes 32 trillion loaves

So the whole world’s RNW is just 30 loaves.

Now consider just Alice. She:

Owns 5 loaves

Owes 32 trillion loaves

So Alice’s RNW is -31,999,999,999,995 loaves.

What about the RNW of everyone apart from Alice? They:

Own 25 loaves

Are owed 32 trillion loaves

So their RNW as a group is 32,000,000,000,025 loaves. In other words, the RNW of this group is actually (far) higher than the RNW of the whole world.

In one way of thinking, this makes perfect sense. If we add the RNW of Alice to the RNW of everyone apart from Alice, we get the world’s RNW of 30 loaves. But from another point of view, it appears that the “everyone except Alice” group will never go hungry, because without producing anything, they could each eat 175 million loaves every day for the next 100 years by calling on the debts owed to them. That obviously can’t happen because that much bread doesn’t exist.

This is what happens when someone is insolvent. RNW tells us what someone will be left with if all debts are paid. Since the insolvent person is unable to pay all of their debts, the rest of the world’s RNW is an overstatement of what they can receive in reality. Unless the insolvent person works their way out of insolvency, the rest of the world will sooner or later have to write off at least some of the debts without receiving anything in exchange, reducing their RNW to a level which reflects reality. In this case, the other people receive 5 loaves in total but have to write off 32 trillion loaves.

One person’s insolvency is the rest of the world’s unacknowledged, and currently-unassigned loss. The only way around the problem is if the insolvent person produces enough so that they are no longer insolvent. If that doesn’t happen, then the only remaining question is who suffers the loss when the person does default, either in bankruptcy or when their estate is liquidated when they eventually die.

Optional Exercise

How is this post relevant to (i) MMT4, and/or (ii) dealing with insolvent banks? If you would like to try answering, please write in the comments. I promise I’ll give it a like!5

Unless Alice somehow worked her way out of insolvency e.g. by producing something.

By this point, Bob had already made a £100 profit, because Alice had promised to give him £200 when he only “invested” £100 originally. The £100 loss would cancel out this profit, and Bob would end up with his original £100, which is annoying but not a disaster. But once Bob was actually paid £200 cash (which was more than he “invested”), someone in future was guaranteed to receive less than they originally “invested”.

Reminder: Raw net worth = what you own + what you’re owed - what you owe. If you’re new to this idea, see the Start Here post.

Modern Monetary Theory, espoused by Warren Mosler, L. Randall Wray, and Stephanie Kelton.

As long as it’s vaguely relevant to the question, and isn’t gratuitously offensive to anyone!