“Enough to Buy Back the Product”

Does a firm need to pay employees enough money to buy everything it produces?

This is the topic of chapter 20 of Henry Hazlitt’s Economics in One Lesson.

According to popular belief, Henry Ford said that he wanted to pay his workers enough that they could buy the cars which the firm produced. Whether this is true or not, some people believe that if firms don’t pay their employees enough to buy all of the firm’s output, some of it can’t be sold because people don’t have enough income to buy it all.

But is that right?

(TL;DR: No!)

First, let’s look at what ‘income’ means.

Stocks, flows and income

Most people think of someone’s income as how much money they receive in one year. That’s a useful starting point.

Now’s a good time to describe the difference between stocks and flows:

A stock is a value at a point in time. Assets, liabilities and raw net worth1 are stocks.

A flow is a change in a stock. It doesn’t have a value at a single point in time2, but is measured over a period of time. Production, consumption, and ΔRNW3 are flows.

Income is a flow. It doesn’t tell people much if you say that you have an income of £20,000 without saying whether it is per month, per year, or perhaps over the time it takes to perform a specific task.

It’s also worth looking at the difference between gross and net income (as understood by most economists):

Gross income (or revenue) is the total amount of money which you received for the things which you sold.

Net income (or profit) is gross income minus the amount of money it cost to produce (or obtain) the things which you sold.

So if Bob’s Motors sold a Model B car for £5,000, if the raw materials cost £1,500, and if it cost £2,500 to pay the employees (and other operating costs, like lighting), then its gross income is £5,000, but its net income is £1,000.

Back to the topic

Bob’s Motors is more complicated than we need for this article, so let’s look at a simpler example. Alice has an orchard, and employs Bob and Charlotte to pick apples for her. She pays them £10/hour. She then sells the apples for 20p each.

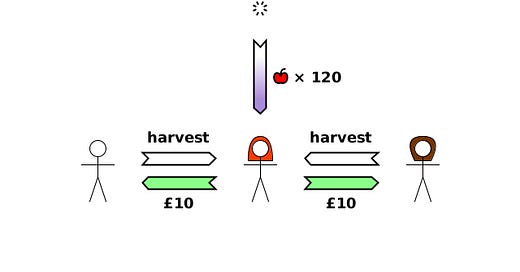

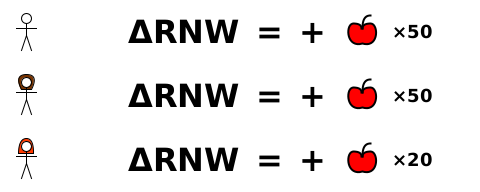

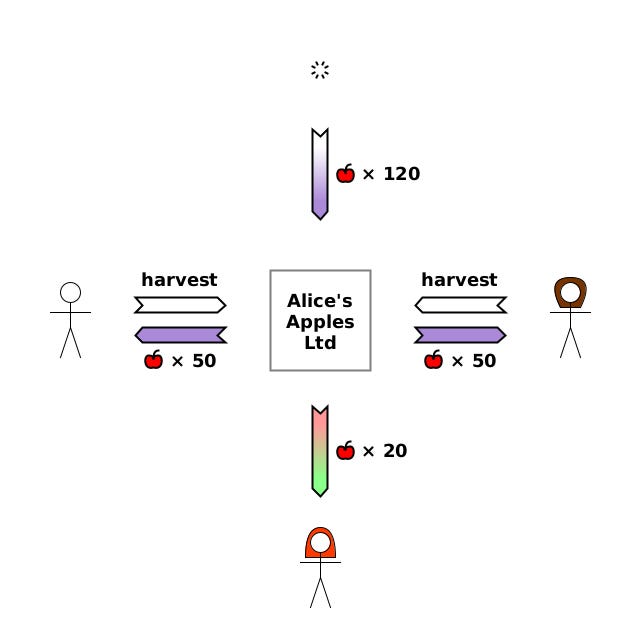

Suppose Bob and Charlotte work for 1 hour each, and each picks 50 apples. Alice pays them £10 each.

Then they buy the 100 apples4 from Alice, which uses up all their wages.

So in this case, all the harvested apples have been sold. But what if Bob and Charlotte harvest 60 apples each in that time?

Where’s the income going to come from for someone to buy the extra 20 apples?

If you’ve been reading this Substack for any time, and know the new One Lesson, you probably won’t be surprised where we’re going next. Instead of measuring income as an amount of money over a period of time, we’ll use ΔRNW over a period of time.

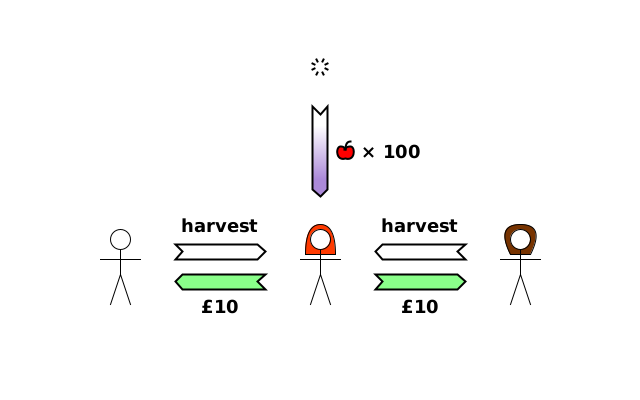

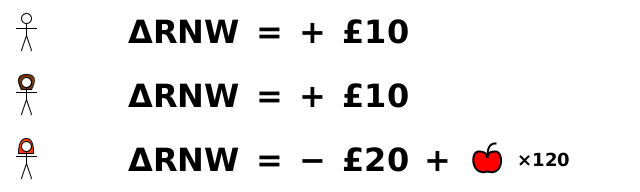

First, over the hour of harvesting:

Bob and Charlotte each gained £10. Alice lost £20 in total, but gained 120 apples.

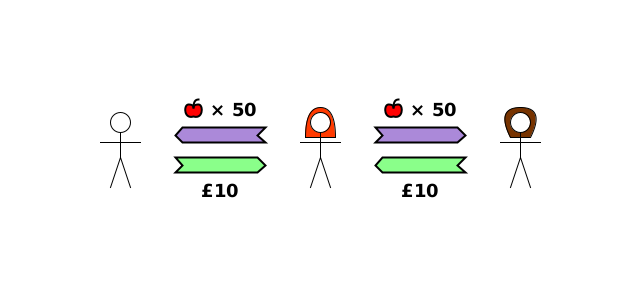

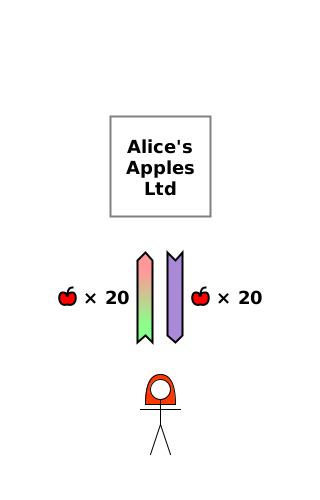

Now let’s look at the changes to everyone’s RNW over the whole scenario (from before Bob and Charlotte start work to after they have bought their 50 apples each). They spent all their wages, so all the money ends up where it started. That leaves just the following changes:

Where’s the income going to come from for someone to buy the remaining 20 apples? It isn’t needed! Alice already has a net income of + 20 apples. She doesn’t need any money to buy them—they’re already hers! If she really wanted to, she could pay herself £4, and buy the apples from herself with that £4, but that would be totally pointless.

This example shows how some economists’ obsession with money (and transactions) can confuse them so much that they jump to absurd conclusions, such as the idea that there might not be enough income to buy everything produced. By looking at RNW instead, it’s very clear exactly what’s going on.

What about a limited company?

Perhaps some economist might say that’s all very well for an individual employing people, but what about if it’s a limited company? If you’ve read the earlier article on equity, you may already see that this makes no difference, but let’s go through it in detail for this example anyway.

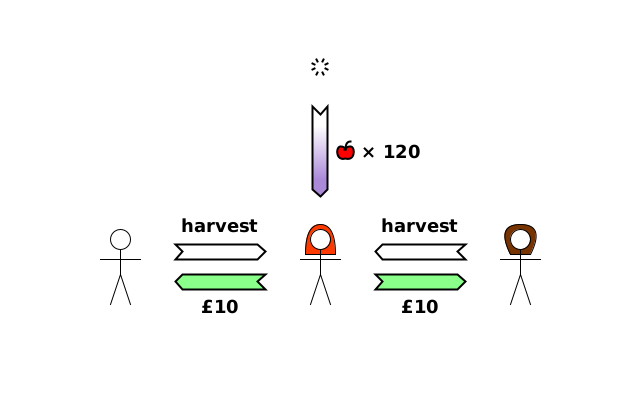

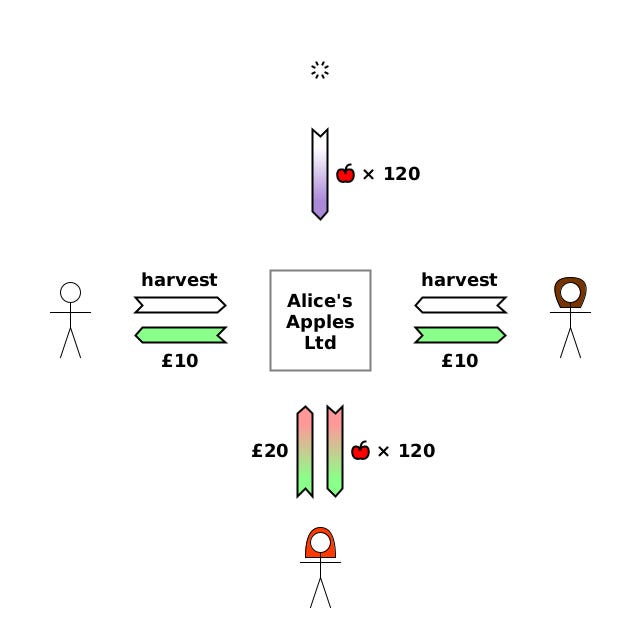

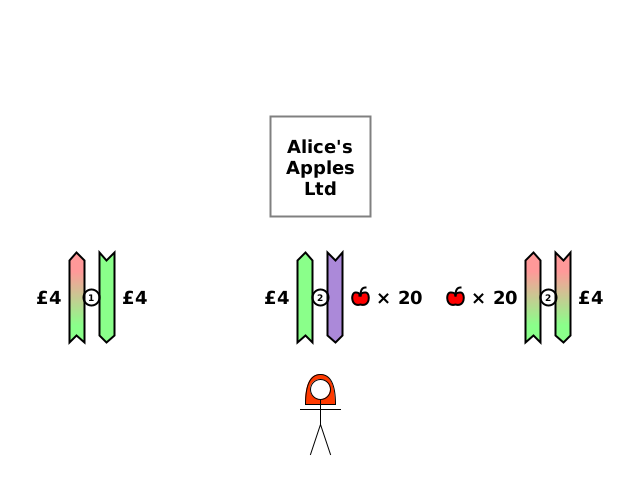

Suppose Alice set up a limited company, Alice’s Apples Ltd, to manage the orchard, and Bob and Charlotte are working for the company. When they harvest 120 apples, the company loses £20 of cash, but gains 120 apples.

At the bottom of the diagram, we can see how its equity changes by - £20 + 120 apples, which means that Alice’s RNW increases by - £20 + 120 apples, because the firm’s equity is a debt owed to her.

When the firm then sells 100 apples to Bob and Charlotte, its equity changes by + £20 - 100 apples.

So over the whole scenario, the firm’s equity change is just + 20 apples, meaning that Alice’s RNW has changed by + 20 apples.

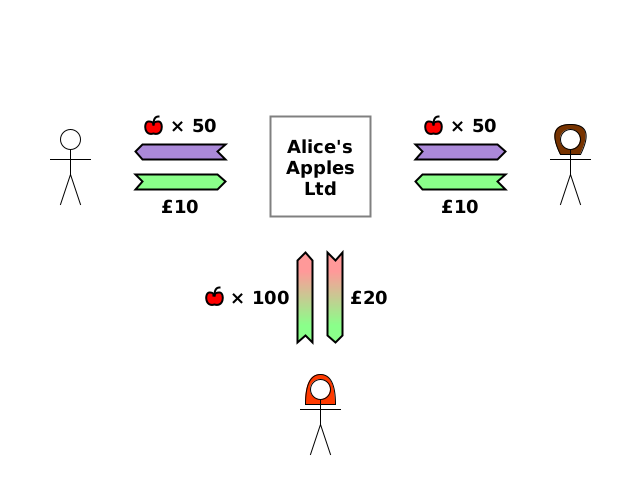

The firm could just give the apples to Alice (decreasing its equity in the process)…

… or it could pay her a dividend of £4, which she could use to buy the apples from the firm. This looks a bit more complex, as it involves (1) the firm giving Alice £4 (reducing the firm’s equity by £4), and (2) Alice buying 20 apples for £4 (reducing the firm’s equity by 20 apples but increasing it by £4), so 6 actions in total.

Either way, the final results are exactly the same.

Summary

When you understand that someone’s net income is just their change in RNW, it becomes clear that questions like, “Is there enough money to buy {something}?” are based on a misunderstanding of money. Just follow RNW, and the answer is clear.

Someone’s raw net worth (RNW) is what they own plus what they’re owed minus what they owe. It is a “heterogeneous” sum/difference, which just means that things of different types are added and subtracted, not monetary “values” which have been assigned to them.

You can say that a flow has an “instantaneous” value at a single point in time, like a car speedometer measures, but I don’t think it’s a particularly useful idea in economics.

Delta means “change in”. So ΔRNW means “the amount by which RNW has changed”.

They both really like apple pie.