A number of economists use ideas from accountancy in their work. Some notable examples are Steve Keen (Debunking Economics), Perry Mehrling (the Money View) and L. Randall Wray (MMT). Unfortunately, the terminology hasn’t been standardised, so terms like “net worth”, “net wealth”, “net assets” and “equity” are sometimes used interchangeably. Not only this, but there are two similar concepts which differ in a crucial way, but in the confusion over naming, the difference is often overlooked.

I’ll call the two concepts net worth and equity. (Or raw net worth1 and raw equity when we don’t assign money values to assets and liabilities, like in the One Lesson).

Net worth, as we’ve already seen, is just assets minus liabilities.

Equity is itself a liability, and is assets minus all other liabilities.

It’s generally only corporations which have equity. It works as a way of transferring what would otherwise be its net worth to someone else. Confusing? It’s actually reasonably straightforward, as we’ll see in an example.

Bank Example

The simplest example is a bank, because basically all of its assets and liabilities are the same type of thing: units of money e.g. pounds. We’ll compare two different situations:

Eve is operating as a bank in her personal capacity, writing personal IOUs which the community around her generally trusts as payment.

Eve sets up a limited company (Bank of Eve Ltd) to operate as a bank on her behalf. She is the only shareholder, and fully controls what it does.

Eve as banker

In the first case, Eve has:

[A] £10,000 cash in a safe (behind the portrait of her great grandfather, if you’re wondering),

[A] £120,000 in loan assets (debts owed to her by borrowers),

[L] £110,000 in deposits (debts which she owes to people who have accounts with her).

Here’s a representation of her assets and liabilities:

And here is her RNW:

So she has a RNW of £20,000.

Bank of Eve Ltd

In the second case, Bank of Eve Ltd has essentially the same assets and liabilities as Eve did in the first case, but with one addition:

[A] £10,000 cash in a vault,

[A] £120,000 in loan assets (debts owed to it by borrowers),

[L] £110,000 in deposits (debts which it owes to people who have accounts with it).

[E] £20,000 equity, the difference between its assets (£10,000 + £120,000) and its other liabilities (£110,000). This is a debt owed to its owners, which in this case is just Eve.

Eve’s assets and liabilities are:

[A] £20,000 equity in Bank of Eve Ltd

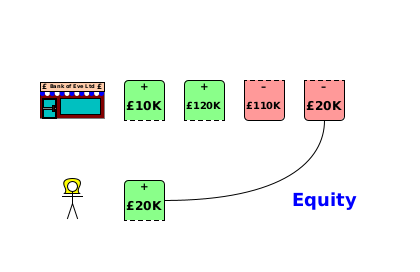

Here is a representation of their assets and liabilities:

Notice how Bank of Eve Ltd has the same assets and liabilities as Eve had when she was acting as a banker herself, but with an additional £20,000 liability (the equity) owed to Eve herself, who has the corresponding £20,000 asset.

Here are their RNWs:

Notice that both when Eve operates a bank personally, and when she has set up a limited company, her personal RNW is exactly the same: £20,000.

Bank of Eve Ltd’s equity is the exact liability needed to reduce its RNW to zero, which has the effect of transferring what would have been its RNW of £20,000 to Eve.

Summary

There are cases where it’s useful to recognise that what would otherwise be the RNW of a corporation is really part of the RNW of one or more other people. The most obvious example is limited companies, which operate on behalf of their shareholders. In this case, the corporation is given a specially-named liability, equity, which is equal to its assets minus its other liabilities, and so reduces its RNW to zero.

As with all debts, there is a creditor with a matching debt asset equal to the corporation’s equity. Or, more often a set of creditors whose matching debt assets add up to the corporation’s equity. In effect the corporation’s RNW is transferred to these creditors.

Important. There is a key difference between (raw) equity and (raw) net worth. As with any other debt, when a corporation has an equity liability, someone else has an equal and opposite equity asset, so their combined RNW (and the world’s RNW) isn’t affected by the existence of the equity. But when someone has a non-zero RNW, there isn’t another person with an equal and opposite “anti-RNW” somewhere else. It’s a part of the whole world’s RNW.

Someone’s raw net worth (RNW) is what they own plus what they’re owed minus what they owe.