There’s a good description on Wikipedia about Charles Ponzi, who ran a type of fraudulent investment scheme which came to be known as a Ponzi scheme. Instead of generating returns to investors by using the investment either to produce goods and services or to speculate on financial markets, it simply involves paying earlier “investors” with the money coming in from new “investors”.

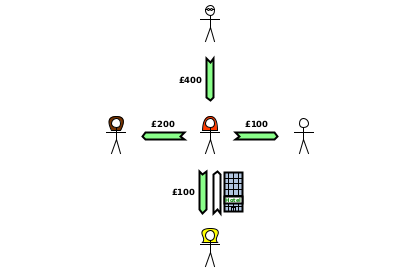

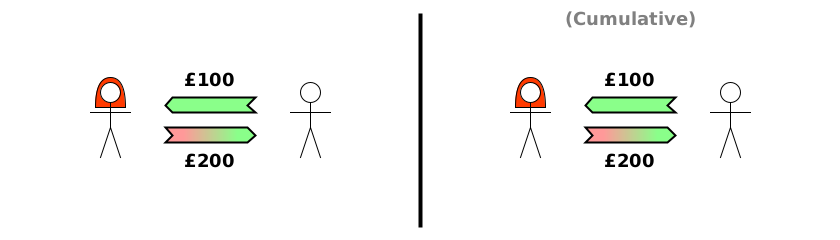

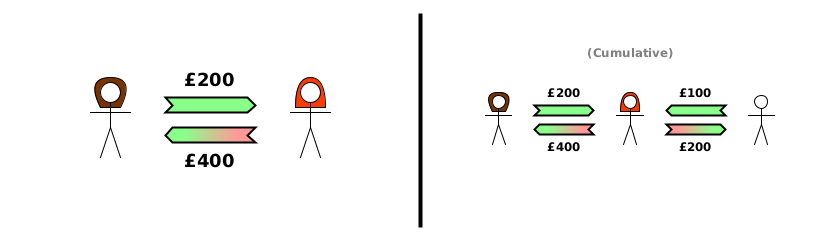

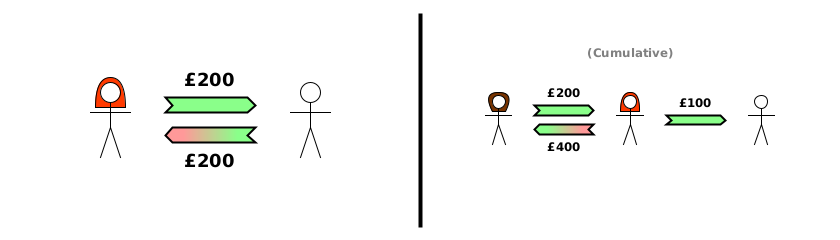

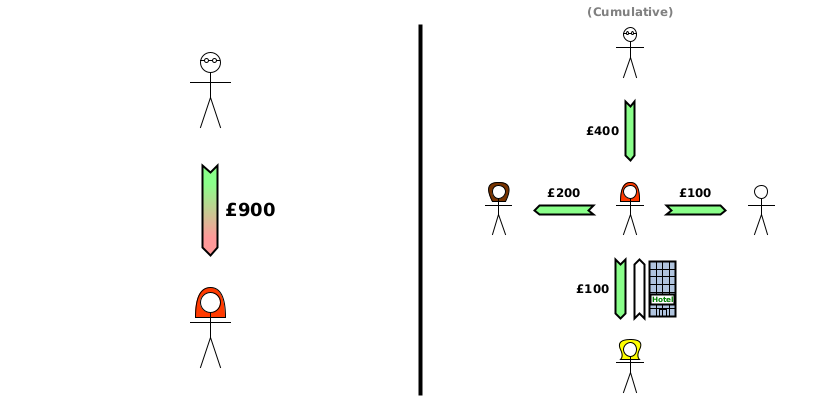

This post shows a simple example. At each stage, I’ll show 2 diagrams. The left side shows how that stage by itself affects each person’s raw net worth, and the right side shows the total changes to raw net worth since the beginning of the whole scenario.

Alice’s Ponzi scheme

Imagine it’s January 2000. Alice has no assets or liabilities (so zero raw net worth), but she makes a new year’s resolution to get rich quick. She goes to the town centre, and tells everyone that she has an “investment” product where she will pay back twice whatever people invest with her after 1 year.

This sounds too good to be true, but the lure of easy returns is enough to tempt some people. Bob has £100 of cash, and decides to “invest” it with Alice, intending to get £200 of cash the following year. He’d still have his original £100 of cash, and could spend the other £100 on a nice meal at his favourite restaurant.

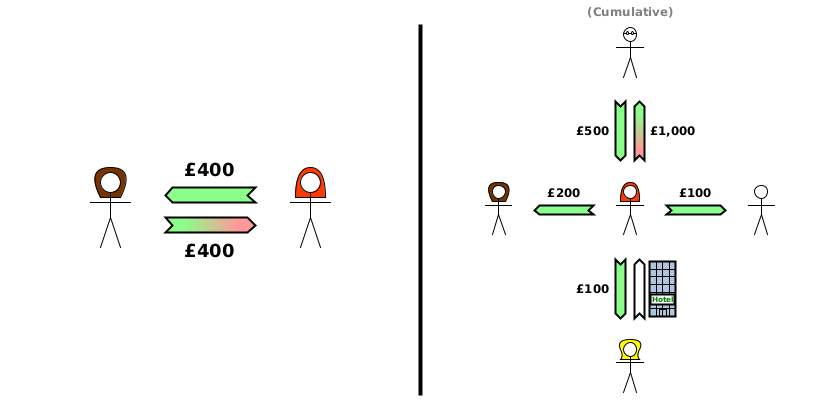

By the end of June, Alice starts worrying about how she’s going to pay Bob in January 2001. She only has the £100 of cash which Bob transferred to her, but will need £200 in 6 months. She needs more cash, so she tries to attract more “investors”. In July, she convinces Charlotte to “invest” £200, promising to pay her £400 in July 2001.

Now she has £300, so she has enough to pay Bob in January. She feels she can relax for a bit. She has a whole year to worry about how to pay Charlotte the £400 she promised.

In January 2021, Alice pays Bob £200.

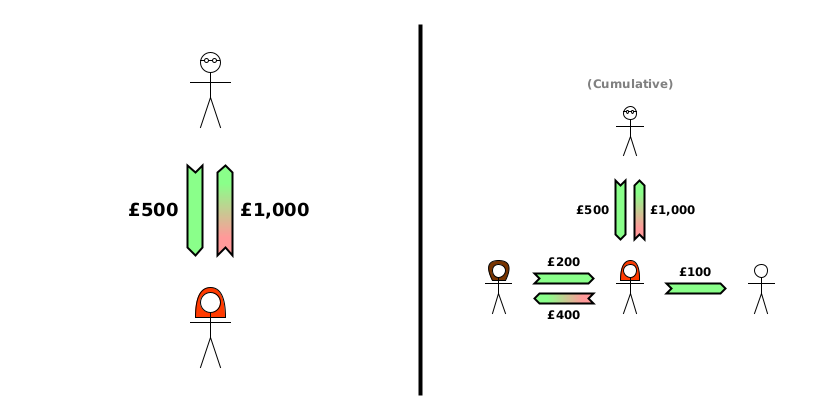

Bob happily tells Dom, the restaurant owner, about Alice’s amazing investment product. Dom decides to “invest” £500 with Alice, hoping to use the investment returns to buy a new oven next year.

At this point, Alice is relieved that she has £600 of cash. She can comfortably pay Charlotte £400 in July, and she has a whole year to find £1,000 cash to pay to Dom.

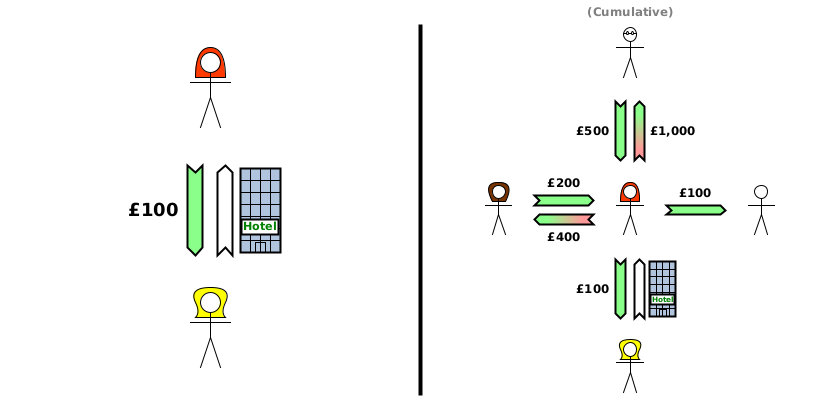

To celebrate, she spends £100 on a weekend break at Eve’s hotel.

In July 2001, Alice pays Charlotte £400, leaving her with just £100.

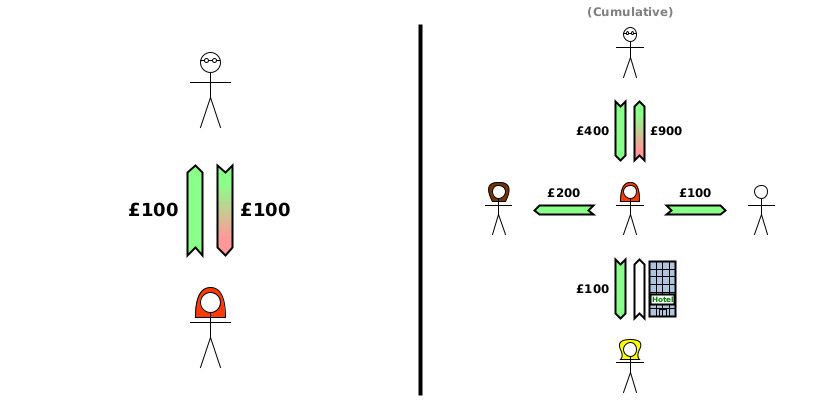

Alice never finds anyone to “invest” any more cash, so when it comes to January 2002, Alice has to admit to Dom that she can only give him £100, in exchange for which he writes off £100 of the debt Alice owes him.

Alice still owes Dom £900, but she has no money left. Not only has Dom not got the extra £500 he was promised, he’s actually lost £400 of his original “investment”. Since Alice has no other assets to sell, Dom will have to write off the £900 he was promised, getting nothing in return.

Look at the final cumulative picture carefully. All the debts which were created in the scenario have now been written off, so it’s particularly easy to see what has actually happened. Essentially, Dom has transferred £400 of cash to Alice, who has given £100 of it to Bob, £200 to Charlotte, and £100 to Eve (in exchange for a weekend stay at her hotel).

Even if Alice is punished by being sent to prison, it doesn’t help Dom to buy the new oven he wanted.

In the next post, we’ll look in more depth at how Alice’s insolvency (not having enough assets to pay all their liabilities) shows right from the start that someone’s going to be defrauded. The only thing which is uncertain is who the victim will be.